Checking, Savings & Investment

Checking

- Insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000.

- Funds are available as soon as they are collected – generally within two business days.

- Numerous deposit options including an area-wide Quick Drop network with daily pick-ups in the St. Louis, Missouri metro area and remote check deposit from your office.

- View all account transactions and check images (front and back) online.

- Monthly service and activity charges can be covered by balances maintained in the account or deducted from the account each month.

- Positive Pay service option automates account reconciliation and minimizes fraudulent activity.

- Interest bearing checking accounts with balances above $500,000

Cass Money Market Savings

- Insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000

- Variable-rate investment account with check-writing privileges (up to six per month)

- Interest compounded monthly.

Cass Sweep Accounts

Sweep accounts minimize the time you spend managing cash, while helping you achieve optimal use of your excess funds. Cass can devise a sweep account plan so that if an account exceeds a certain level, the excess amount can be swept into a higher, interest-earning money market account. Or, the excess could be automatically applied to pay down the balance on your credit line.

Similarly, if an account falls below a certain level, we can sweep funds from another account or from your line of credit so that you can maintain a target balance. Clients will often set up such a sweep to keep the balance of their business checking account (also called demand deposit account) from falling below the target balance set for the account. In this way, you are protected against costly overdrafts. Cass can sweep across multiple deposit accounts and lines of credit. Your account team will meet with you to understand your cash flows and goals, and create a tailored plan for your business.

Certificates of Deposit

Managing millions of dollars of cash has never been easier – or safer.

- Term options from three months to five years

- Minimum CD amount as little as $1,000

- Interest accrues daily and is paid quarterly.

- Interest can be added to a certificate, paid by check or deposited into a deposit account.

- Certificates renew automatically at current market rates.

- Insured by Federal Deposit Insurance Corporation (FDIC)

Talk to your Cass representative about structuring a custom savings plan today.

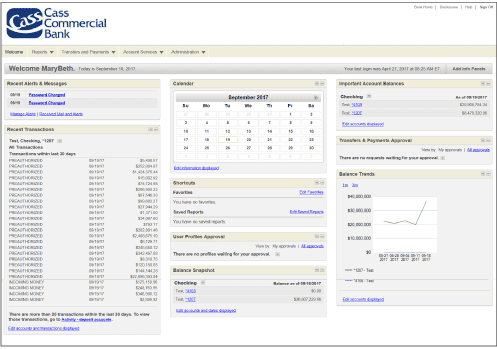

See what you want, the way you want it.

There’s nothing like

a custom dashboard to

replace confusion with clarity.

Your Cass account team is ready to help you customize your dashboard.